Usher in a New Era of Value Chains: Explore Xone’

In the wave of rapid development in the blockchain industry, decentralized finance (DeFi) has made significant breakthroughs over the

Making users the masters of the network is what really drives the program forward.

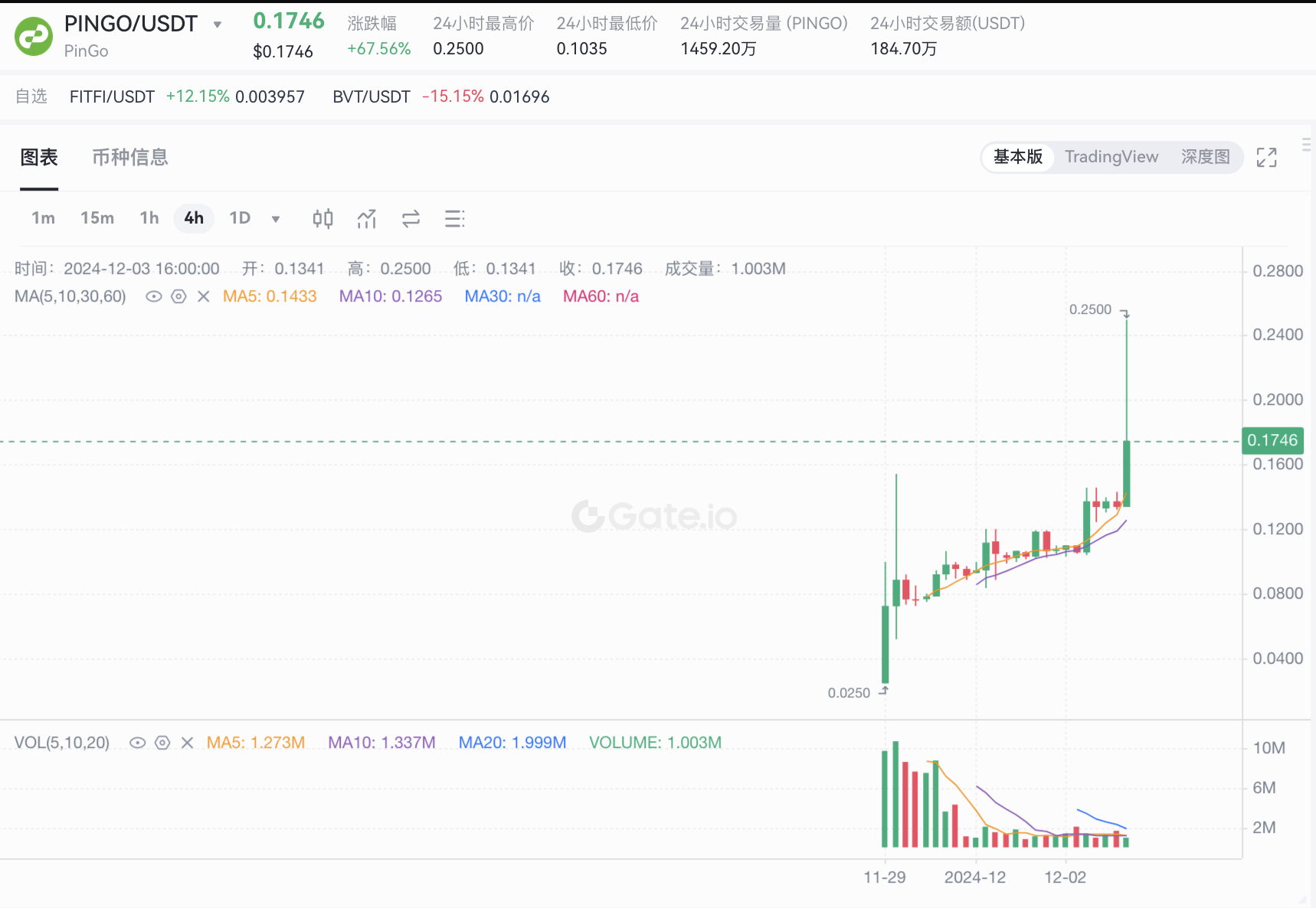

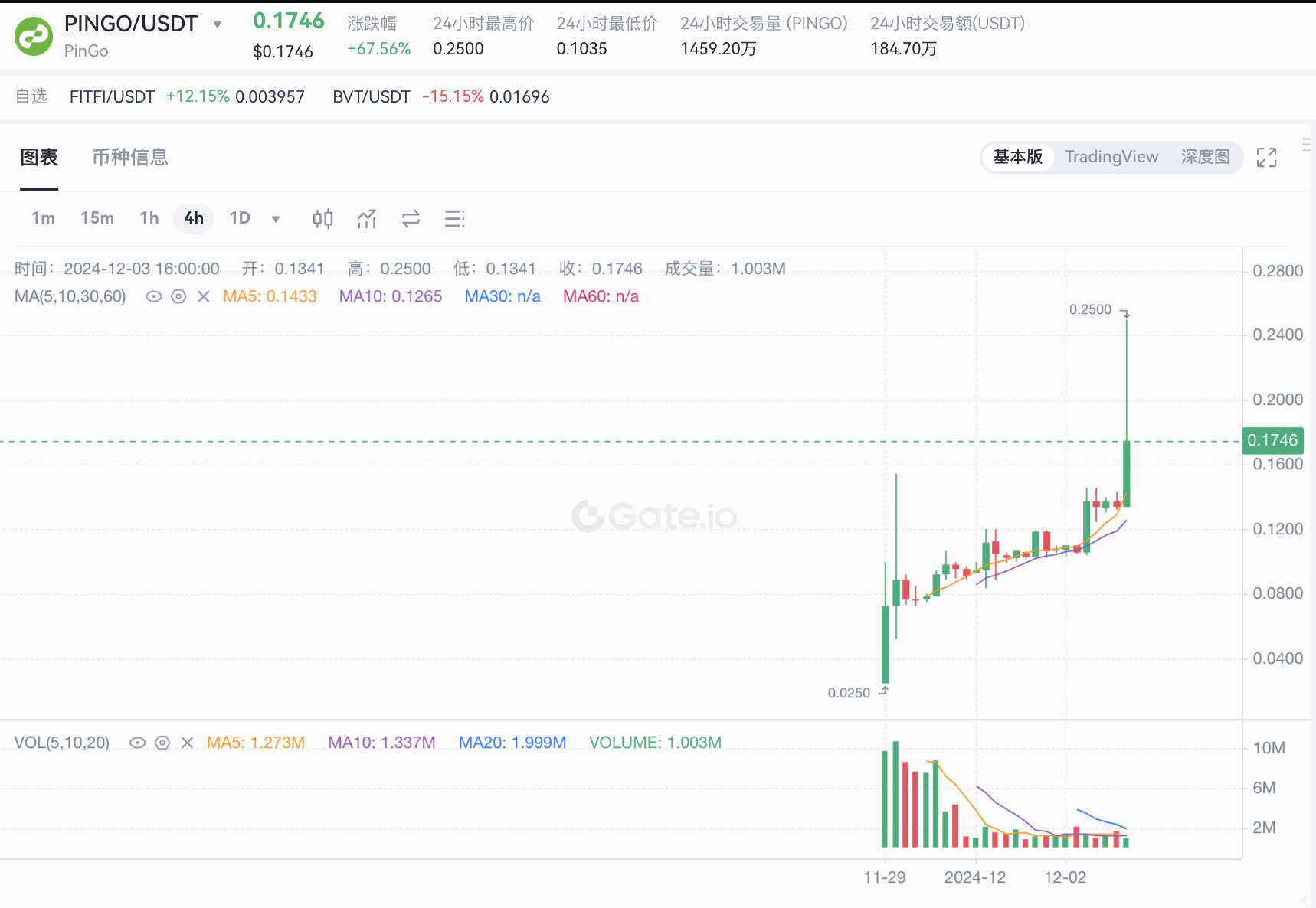

Last Friday evening, PINGO, the economic token for TON Eco AI infrastructure PinGo, went live on the Gate.io exchange, and after trading began, PINGO tokens went through a period of oscillating upward movement after minor adjustments, breaking the "habitual" trend of a large number of tokens peaking at the launch of their tokens. At a maximum price of around $0.25, PinGo's FDV came to around $250 million.

What did PinGo do right to keep its token price from going all the way down after launch? Is there still room for its token price to rise in the time since?

Fundamentals of PinGo

PinGo is an AI+DePIN project of Ton ecosystem, aiming to effectively utilize scattered and idle arithmetic power, and provide arithmetic resources for the development of AI models through DePIN and decentralized cloud solutions. The concept covers current hot AI, DePIN, TON, etc. It starts from the Telegram ecosystem to accumulate seed users, and gradually builds up a planned CDN network to realize a decentralized storage and computing resource network, which empowers the training and development of AI. (For a detailed explanation of PinGo, please refer to "In-depth Explanation of PinGo: Entering the AI Market from Telegram, a Great Dream of Decentralized Arithmetic Network").

From PinGo's official documents, PinGo's core team has rich experience in community and marketing. Most people's misunderstanding of AI projects is that the core team needs to have rich technical skills, but in fact the core AI technology is accomplished by a handful of talented geniuses, and at the application level, the operator of the AI product needs to be able to make the product known and used by more people, and the current team configuration of PinGo perfectly demonstrates its ability in operation.

In October this year, PinGo completed a kind of sub-series financing with the participation of TFund, CGVFOF, K24Ventures, CatcherVC and LandScape Capital, etc. TFund is a fund focusing on investing in the TON ecosystem, which indicates that PinGo has somehow gained the recognition of the participants in the TON ecosystem, and may receive more support from TON in the future. TFund is a fund focused on investing in the TON ecosystem, indicating that PinGo has been recognized by TON ecosystem participants to some extent, and may receive more support from TON in the future.

In addition to financing, PinGo, also with the DePIN concept, has also completed the sale of 10,000 NAS servers, which are the node machines that will build the project's core CDN network. For projects with the DePIN concept and completed hardware sales in the early stages, the most important point is that the project will not lack cash flow in the early stages, and do not need to sell tokens to obtain funds for project development. So the hardware sale for PinGo not only completes the construction of its network core, but also solves the problem of funding, two birds with one stone.

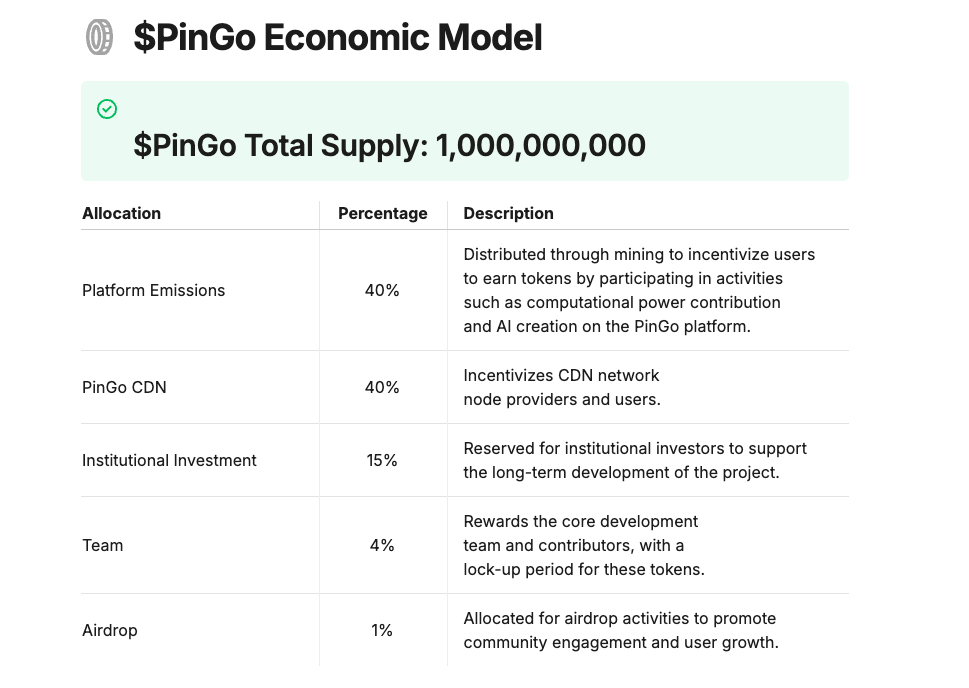

Highly community-based economic model

PinGo's token economy model design is not original, but it is refreshing.

As you can see from the token economy model table, investors account for 15%, teams account for 4%, and airdrops account for 1%, while half of the 80% is allocated to users who mine through various usage behaviors, and the other half is allocated to the builders of the CDN network.

A small number of airdrops coupled with the team and investor shares that need to be unlocked for a long period of time, this design means that there are not too many chips in circulation in the market at the early stage of the tokens' launch, and most of the tokens need to be actually used by the users before they are slowly produced, and in this process, including the establishment of CDN network nodes and other behaviors also need to purchase tokens for pledging, which creates a balance of token supply and demand in the mid-term, so that tokens do not The dilemma that tokens will not go all the way down because of too many chips unlocked at an early stage.

PinGo's economic model is clearly well thought out, and draws on the problems associated with a large number of projects that have over-designed their airdrops in order to gain sufficient exposure in the early stages. If the airdrop percentage is too high, while it may be able to bring high attention in the early stages, it is also likely to become a target for 'short hunters', which will lead to a sustained crash after the tokens go live and the airdrops are released.

If the proportion of teams and investors is too high, the market will be worried about "VC coins", and even if the project itself is of high enough quality, it will choose to wait and see for a long time for fear of becoming the "receiver" of capital, which will also make the token price continue to go down, and further reduce the desire of investors to buy, forming a vicious circle.

PinGo's token economic model design avoids these pits, which also confirms what I said above, technology is not the only factor that determines the success or failure of the project, operation may be more important at some point. The scarcity of chips in the early days, coupled with the recent market continues to improve, the price of PINGO may continue to go up, not to give observers the opportunity to get on the car.

What will be the short-term price of PINGO?

I took two screenshots, the first is the 2-hour K chart of PINGO after it went live on Gate.io, and the second is the 2-hour K chart of the DYM token after it went live on Coin.com, and both started off very similarly.

As we all know, token prices often follow a pattern, and as a market that isn't liquid enough and doesn't have enough participants, it often follows a similar pattern. Bitcoin has been oscillating in the $50,000 to $70,000 range for half a year now, and one of the best reasons to believe that it will reach new highs is that it has never oscillated in a relatively high price range for so long before turning down.

While this may sound like a bit of a stretch, often times the path is simple, and you can't always think too rationally when faced with an immature market.

In my personal opinion, a project in the field of AI, coupled with the careful design of the project team, the valuation of $100 million is obviously not the limit of PinGo in the current hot market environment. After the opening of the coin price did not show any obvious decline, and based on the current trend, I believe that the price of tokens may still have room to rise in the coming period of time.

From the perspective of circulating market capitalization, PINGO's current circulating market capitalization is only a few million dollars, which is even a very early stage for Meme, and for a project that has gained the recognition of the organization's real money, a circulating market capitalization of tens of millions of dollars can be expected in the short term.

Recently, a large number of projects that have been almost "sentenced to death" have begun to rise in price without looking back, Ripple token XRP is once again heading for new highs after a baptism that may have lasted nearly 10 years, and PINGO has a small amount of circulation in its early stages, but it involves enough concepts, including TON, AI, DePIN, and so on, so that once a certain concept becomes the object of speculation, the price of its token may rise very considerably. Once a concept becomes the subject of speculation, its token price may see a very sizable increase, so investors should pay close attention to it.

In the wave of rapid development in the blockchain industry, decentralized finance (DeFi) has made significant breakthroughs over the

In the wave of rapid development in the blockchain industry, decentralized finance (DeFi) has made significant breakthroughs over the

In the wave of rapid development in the blockchain industry, decentralized finance (DeFi) has made significant breakthroughs over the