Phil Orlando hasn't heard so much talk about stagflation since he was a financial journalist in the late 1970s, when oil prices soared and inflation was more than twice its current level.

Now Orlando, chief equity market strategist at Federated Hermes Investors, says stagflation is expected to make a comeback and is taking a toll on some companies.

He said, "It turns out that the spike in inflation is not as temporary as the Federal Reserve (Fed) and the Biden (Joe Bide) administration have been telling us, and that inflation will persist as our economy crosses peak growth. That's stagflation."

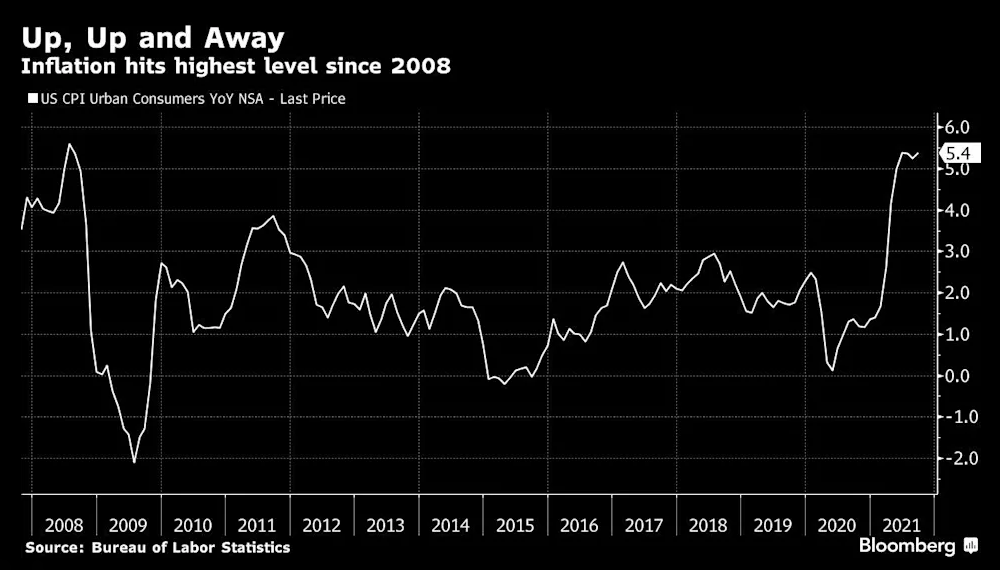

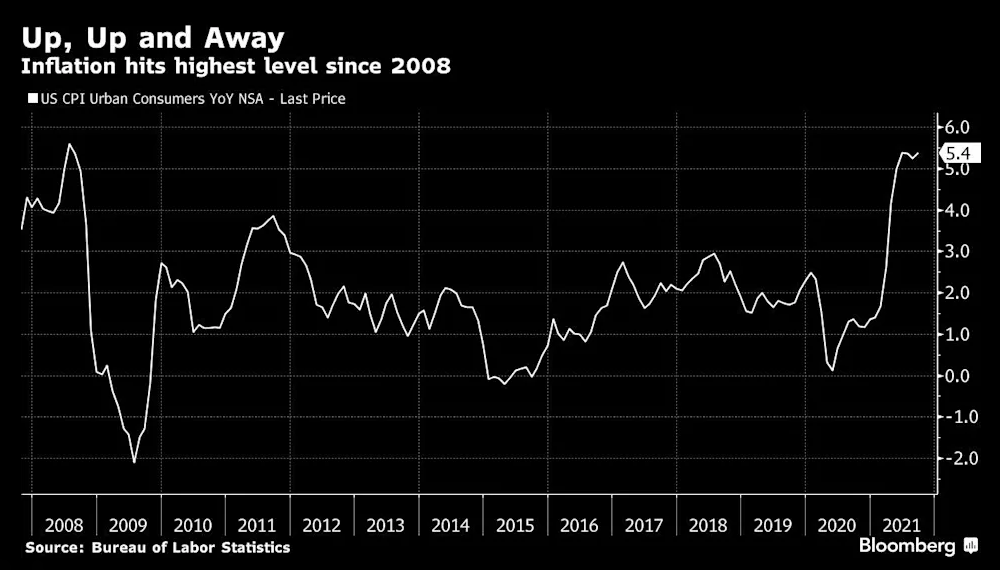

In September, the United States (USA) consumer price index (CPI) rose 5.4% year-on-year, while this year's CPI is expected to record the highest rate of increase since 1990, analysts attribute high inflation to soaring commodity prices, as well as the epidemic crisis (Covid-19) during the U.S. $5.3 trillion fiscal stimulus measures. Meanwhile, U.S. gross domestic product (GDP) growth is expected to be just 2.7% in the third quarter, compared with 6.7% in the previous quarter.

The percentage of long and short oil price movements, Bloomberg crude oil trend survey, Bloomberg crude oil survey, crude oil trend survey, crude oil long and short analysis, crude oil weekly strategy, crude oil weekly report, how international oil prices will move next week, long and short international oil prices

U.S. CPI Rises to Highest Level Since 2008 _By Bloomberg

Most economists believe stagflation is not inevitable, and the Federal Reserve says price increases will be temporary. Meanwhile, financial markets are performing well, with the S&P 500 up 22.1% this year and continuing to reach new highs.

However, many investors remain wary of this.

This month, Google (Google) in the "stagflation" search volume is expected to reach the highest level since 2008. Goldman Sachs (Goldman Sachs) chief U.S. equity strategist David Costin said that stagflation is now "the most common word in client conversations. A survey by Bank of America Global Research (BofA Global Research) showed that the number of fund managers expecting stagflation increased by 14%, reaching the highest level since 2012.

Louis Navellier, chief investment officer of Navellier & Associates, said, "Clearly, the alarming economic slowdown suggests the possibility of stagflation. We will tighten all portfolios as we see we enter a tunnel and the equity markets become more tightened."

An economy in stagflation is certainly bad for the stock market. According to Goldman Sachs, the S&P 500 has fallen an average of 2.1 percent quarterly during past periods of stagflation, compared to an average gain of 2.5 percent in other periods.

The percentage of long and short oil price movements, Bloomberg crude oil trend survey, Bloomberg crude oil survey, crude oil trend survey, crude oil long and short analysis, crude oil weekly strategy, crude oil weekly report, how international oil prices will move next week, long and short international oil prices

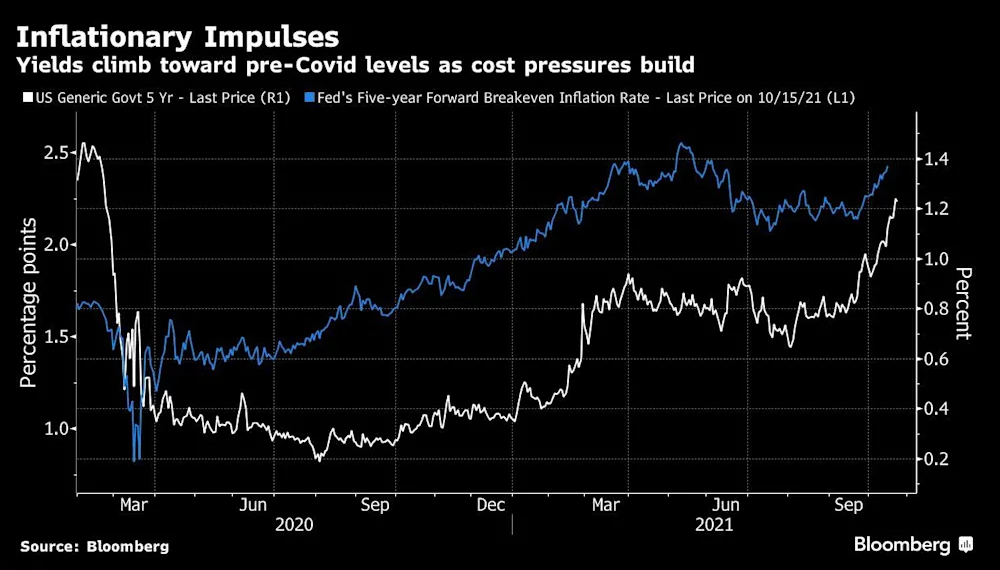

Yields Climb Toward Pre-Epidemic Levels as Inflationary Pressures Increase _By Bloomberg

Bonds also struggled during the last major period of stagflation, which began in the late 1960s. Soaring oil prices, rising unemployment and accommodative monetary policy pushed the core CPI to a high of 13.5% in 1980, prompting the Federal Reserve to raise interest rates to nearly 20% that year.

According to data compiled by New York University professor Asworth Damodaran, the benchmark 10-year U.S. Treasury bond fell in nine of the one years prior to 1982. Inflation erodes the purchasing power of future cash flows from bonds.

Federated Hermes' Orlando portfolio shifted to companies with greater pricing power, including energy and industrial companies. And Navellier & Associates' Navellier focuses on large retailers with supply chains, such as Target.

Some institutions, however, insist that the economy will not fall into stagflation and that the outlook for financial markets remains positive.

Stagflation is not our basic expectation as economists, but the weak historical performance of stocks in a stagflationary environment helps explain why investors are concerned," said Goldman Sachs' Kostin. Despite the uncertainty, we expect stocks to continue to rise as investor confidence that current inflation is 'temporary' increases ."

Scott Kimball, co-head of U.S. fixed income at Bank of Montreal (BMO) in Canada, said, "We think the market is at the peak of stagflation concerns. The potential infrastructure bill -- which is a major source of inflation concerns -- but it's a long-term spending plan that won't have an immediate economic impact."

Jean Boivin, head of the BlackRock Investment Institute, expects economic growth to accelerate as supply bottlenecks ease. He said, "The inflationary pressures we expected have emerged. However, this is not stagflation and we remain supportive of risky assets."

Analysts at UBS (UBS) said that in addition to higher oil prices, stagflation in the 1970s was driven by factors unlikely to occur today, including government price controls that limit supply.

What is not clear is whether the threat of rising inflation will force the Fed to take a more hawkish stance. The Fed is already poised to begin tapering its asset purchases (QE), which could put pressure on stocks if the process moves quickly and/or the Fed pushes more aggressively to raise interest rates.

Jason England, global bond portfolio manager at Janus Henderson Investors, said, "If you're still seeing inflation at current levels next year and the economy isn't growing back, then you have to think the Fed will act."

Jim Reid, strategist at Deutsche Bank, said, "With commodity prices spiking again and inflation concerns resurfacing, investors need to start positioning for a more hawkish response from central banks."

Related posts

2022-01-13

10 mins read

12863 Views

Imagine getting that luxury car youve always wanted on your wish list, or being able to interact with your friends from all over the w

2022-01-13 10 mins read 12863 Views

Imagine getting that luxury car youve always wanted on your wish list, or being able to interact with your friends from all over the w

2022-01-13 10 mins read 12863 Views

Imagine getting that luxury car youve always wanted on your wish list, or being able to interact with your friends from all over the w