Introduction

The core of the SFT Protocol is its community—a decentralized ecosystem comprising developers, users, and contributors who share a strong belief in the power of decentralized physical infrastructure networks (DePIN). SFT Chain is dedicated to bridging the physical world with Web3, and its tokenomics plays a crucial role in driving the incentive mechanisms, governance systems, and sustainable growth of the network.

rSPD, as the early tokenized rewards system of the SFT ecosystem, has been designed with careful research and thoughtful planning to promote the healthy development of the DePIN ecosystem and accelerate the adoption of decentralized physical infrastructure networks.

I. SFT Chain Overview

SFT Chain is a Web3 application chain built on a multi-chain integration (Chain of Chains) architecture. It focuses on bridging physical infrastructure with blockchain technology, creating a DePIN platform that encompasses areas such as aggregated storage, computing, and edge CDN services. The goal of the SFT ecosystem is to drive application innovation, provide users with more secure data management capabilities, and expand the use cases for online services, ultimately enhancing the overall Web3 experience.

II. rSPD Token Overview

rSPD is the early rewards system of the SFT Protocol network, allowing holders to directly access various services within the DePIN network. Unlike traditional centralized reward systems, rSPD is not issued or sold by any specific company but rather enables users to directly interact with DePIN services via a decentralized protocol.

Key Uses of rSPD:

•Compute Resource Allocation: rSPD is used to allocate compute resources and time between DePIN service providers, ensuring efficient operation.

•Mainnet Exchange: After the launch of the SFT Chain mainnet, rSPD can be exchanged 1:1 for the mainnet token, facilitating a smooth transition to the main network.

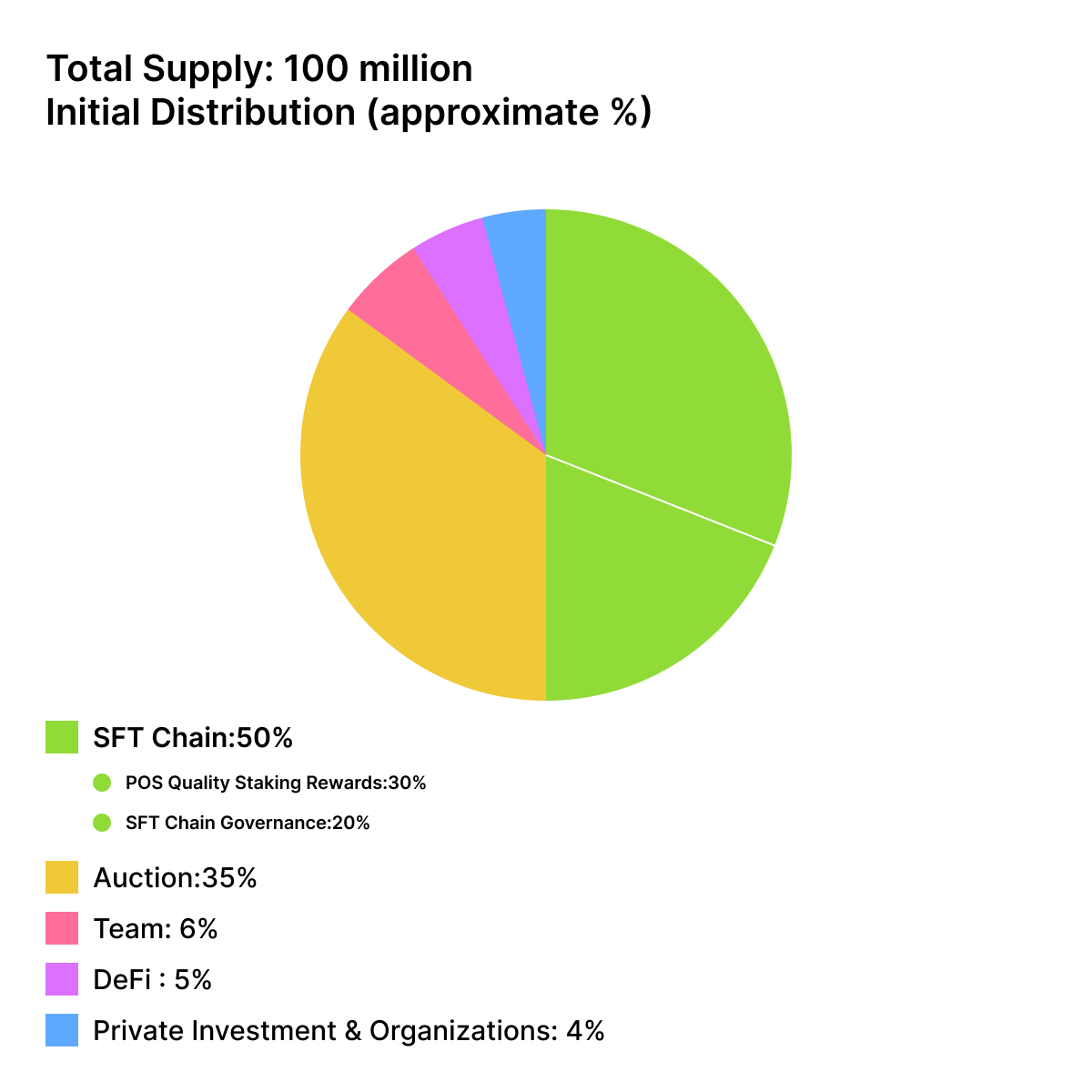

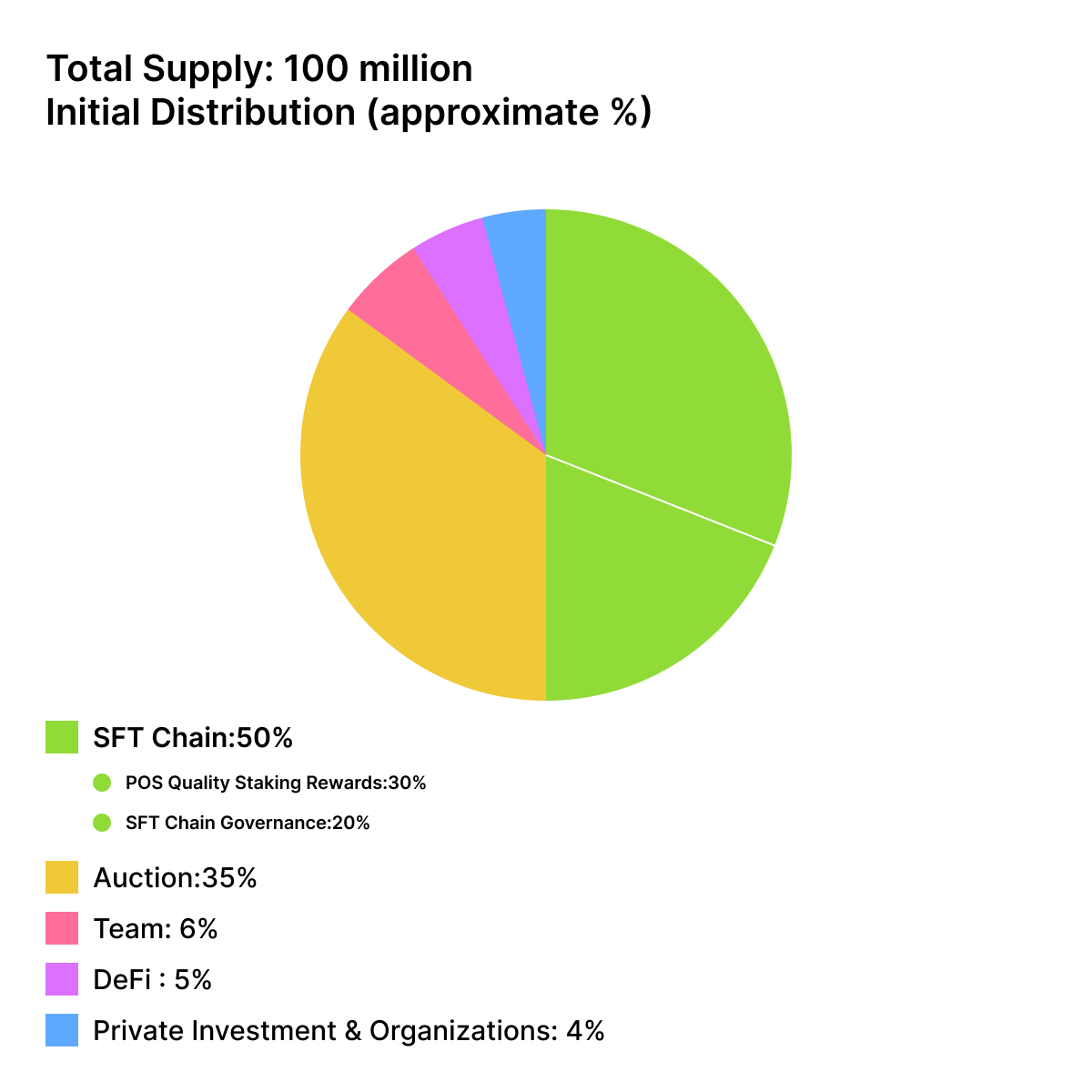

III. rSPD Token Di

stribution Model

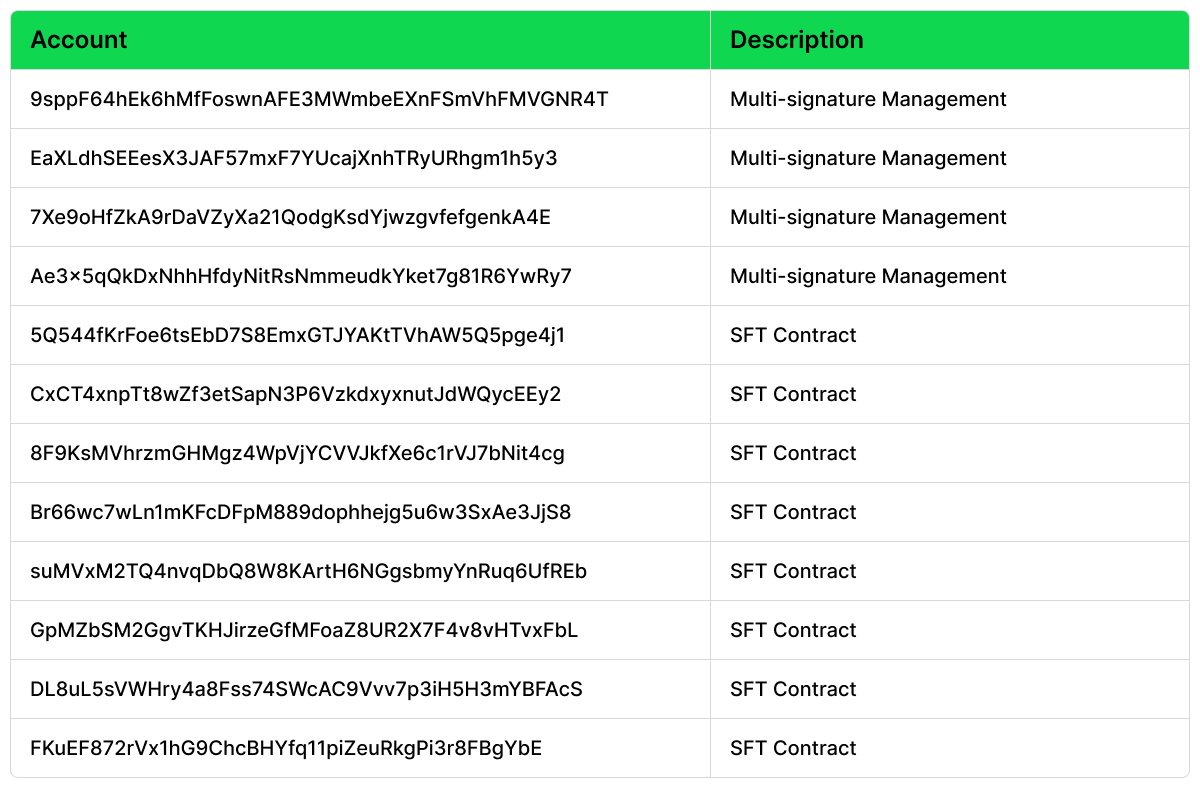

The total supply of rSPD tokens is fixed, and its distribution model is designed to ensure the long-term sustainability of the ecosystem. Strict token release mechanisms maintain a balance between supply and demand, promoting a healthy economic cycle. The distribution is fully managed by multi-signature wallets and smart contracts to ensure transparency and security.

On-Chain Distribution of rSPD:

IV. Core Functions of rSPD

rSPD plays a critical role in the SFT ecosystem with the following applications:

•Access to DePIN Devices

rSPD holders can use their tokens to access computing resources and storage facilities within the network, enhancing their computing power and data interaction capabilities.

•Incentive Mechanisms

Ecosystem contributors can earn rSPD rewards through contributions such as providing computing power, operating nodes, and community building, thereby supporting the long-term growth of the SFT network.

•Staking

Holders can stake rSPD to earn ecosystem rewards and contribute to the security of the network.

•Governance Rights

rSPD gives holders decentralized governance rights, allowing them to vote on key matters such as protocol upgrades and adjustments to the tokenomics model.

V. rSPD Deflationary Mechanism and Buyback & Burn

1.Deflationary Mechanism

rSPD employs a deflationary economic model through regular token burns to reduce the circulating supply. As demand remains stable or grows, this mechanism helps increase the scarcity of rSPD, maintaining the long-term health of the ecosystem.

2.Core Objectives of Buyback & Burn Mechanism

The buyback and burn mechanism aims to achieve the following four objectives:

•Hardware Asset Tokenization: Bringing real-world hardware assets on-chain, giving them digital value, and enabling DePIN device on-chain ownership.

•Building an Economic Loop: Creating a closed-loop economic system through token buybacks, burns, and incentives to foster positive interaction among ecosystem participants.

•Market-Based Auction Pricing: Using a public auction mechanism to ensure that the buyback price of rSPD is determined by the market, ensuring transparency and fairness.

•Dynamic Equilibrium of Supply and Demand: Optimizing the balance between token supply and demand, preventing market volatility caused by sudden supply shocks, and maintaining token stability.

•rSPD Auction & Buyback Process

. 35 Rounds of Auction: The auction process consists of 35 rounds, with 1 million rSPD tokens available per round. All users can participate.

. Market-Based Pricing: The auction price is determined by the market to avoid single-point pricing risks and ensure the reasonableness of rSPD’s price.

. Incentives & Long-Term Release: rSPD acquired through auctions will be released linearly over 12 months to reduce short-term selling pressure and encourage long-term holding.

. Smart Contract-Driven Buyback: All buyback and burn processes will be automatically executed by smart contracts to ensure transparency and immutability, with transaction records being recorded on-chain for full traceability.

•Buyback & Burn Execution Process

. Revenue Generation: The DePIN hardware infrastructure generates stable daily income based on Proof of Work (PoW) mechanisms.

. Price Collection & Conversion: Asset prices are gathered via time-weighted average price (TWAP), volume-weighted average price (VWAP), or decentralized oracles and converted into USDT (U).

. Fund Allocation & Buyback: 50% of daily revenue will be used for rSPD buybacks through auctions. The remaining 50% will be used to match the buyback amount with market cap changes and injected into liquidity pools (LP).

. Liquidity Pool (LP) Token Burn: All LP tokens will eventually be burned (sent to a black hole address), locking liquidity permanently and reinforcing the deflationary effect.

VI. Advantages of the Mechanism and Future Outlook

1.Mechanism Advantages

. Enhanced Token Value: Continuous buybacks and burns increase the scarcity of rSPD, maintaining long-term economic stability.

. Healthier Economic Cycle: By integrating hardware asset tokenization, node redemption, liquidity destruction, and other mechanisms, a closed-loop economy is formed.

. Increased User Confidence: All key processes are executed through smart contracts, ensuring transparency, decentralized governance, and immutability.

2.Future Outlook

. DePIN Ecosystem Expansion: Broaden the scope of physical infrastructure use cases to accelerate the maturation of the DePIN ecosystem.

. Governance System Enhancement: Continuously optimize the governance weight of rSPD in the community, guiding the SFT ecosystem toward greater decentralization.

. Mainnet Upgrade: Ensure a smooth transition from rSPD to the mainnet token SPD, providing robust economic support for the future DePIN ecosystem.

3.About SPD

SPD is the mainnet token of SFT Chain. Currently, rSPD serves as the early token rewards system of the SFT Protocol network. After the mainnet launch, rSPD can be exchanged 1:1 for SPD, facilitating a smooth transition. rSPD holders can still enjoy DePIN services and interact within the open-source ecosystem of SFT Protocol, without engaging directly with any specific company or institution.

The upgrade of the rSPD economic model will further promote the sustainable development of the SFT Chain ecosystem and drive the long-term prosperity of the DePIN network.

Please note, rSPD tokens do not represent an investment opportunity.

Related posts

2025-02-21

10 mins read

8167 Views

The New Society Gaming Platform (NSGP) has officially unveiled its revolutionary approach to blockchain gaming, setting a new benchma

2025-02-21 10 mins read 8167 Views

The New Society Gaming Platform (NSGP) has officially unveiled its revolutionary approach to blockchain gaming, setting a new benchma

2025-02-21 10 mins read 8167 Views

The New Society Gaming Platform (NSGP) has officially unveiled its revolutionary approach to blockchain gaming, setting a new benchma